To borrow or not to borrow for infrastructure?

Kampala, Uganda | IAN KATUSIIME | Julius Kapwepwe, the director of programmes at Uganda Debt Network, a debt monitoring NGO, Uganda’s national says, to control the country’s spiraling debt, the Ministry of Finance officials must ask themselves some questions every time they are packaging a loan request.

Where do our domestic revenues go for every major project we borrow? At what cost are we borrowing? To what extent are we borrowing? These are some of the usual questions economic experts throw at Finance officials every time there is a loan government is acquiring.

The spiraling national debt was in the news for the last one week and the Ministry of Finance officials appearing before the parliament committee on budget had no clear answers as they took the heat from committee members led by chairman Amos Lugoloobi on how to rein in uncontrolled borrowing and spending. The debt was Shs68trillion on April 15.

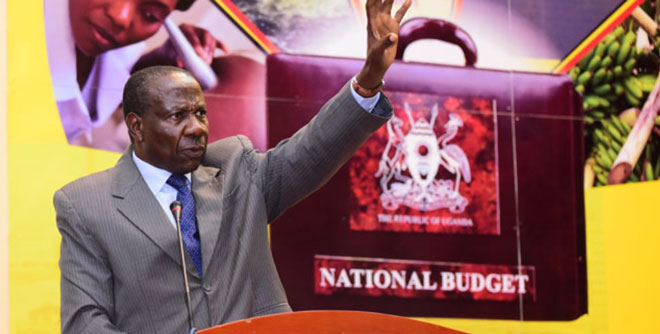

“The debt burden is unbearable. As a committee we want to know how you are going to bring down this problem” Lugoloobi asked Matia Kasaija, Minister of Finance Kasaija who was flanked by his deputy David Bahati; Deputy Treasury to the Secretary Patrick Ocailap; Kenneth Mugambe, Director of Budget.

“What assurances do you give to Ugandans in dealing with this debt crisis?” Lugoloobi said.

Kasaija’s usual fallback position of giving incentives to manufacturers and farmers did not cut it. It also emerged that in an interview with Reuters, Kasaija was reported as saying he may approach Uganda’s main creditors like World Bank, International Monetary Fund (IMF) and China for debt relief.

And MPs grilled the Finance officials over what looked like padding of the budget as the committee found that other allocations to his Finance Ministry were a duplication of other ministries roles.

In 2020 Uganda took up a number of loans to deal with the unexpected covid19 pandemic and its impact on the economy. One of the first loans was signed in April, one month after the lockdowns, a $300m facility from the World Bank. Soon after European Union extended the country 125million Euros to boost the private sector.

In May, the IMF approved a loan of $491.5m under the Rapid Credit Facility (RCF) to help the country overcome its economic difficulties.

In July, African Development Bank lent Uganda $31.6m to boost the government’s response to covid19. After, it was hard for some to keep up with the rate of government borrowing. Reuters reported that the national debt has grown at 35% in the last one year. The appetite for loans has not relented even as the economy has slightly opened up although with the lingering effects of the devastation wrought by the lockdowns.

Borrowing criticised

There has been a lot of criticism of the government for the growing public debt as a result of an incoherent policy on borrowing and some say President Yoweri Museveni and his cabinet have a cavalier attitude on the issue because they know they are passing the debt baton to another generation.

However other commentators have said discussion on public debt must put into context certain factors because almost all governments in Africa are borrowing heavily to invest in transport and energy factors. They cite the East African project; the Standard Gauge Railway, which will see Kenya, Uganda, Tanzania, Rwanda all incur debt in the region of $2bn.

Uganda borrowed to the tune of $2bn for Karuma and Isimba; two of the biggest hydro power projects in the country. Although Isimba was commissioned in 2019, it is the delayed works on the 600MW Karuma dam that is ticking some people off.

Karuma whose construction works commenced in 2013 has suffered numerous delays by the contractor and some have started questioning the value for money for a project that was supposed to be completed in 2019. The completion date of the project seems to have become a moving target just like the national debt figure which is expected to grow further into the next financial year.

The loan for the construction of Karuma was $1.7bn from the Exim Bank of China. Isimba was financed by the same bank at $567m. In both projects, the government of Uganda financed a measly 15%.

Those optimistic about the projects say the returns on investment will be invaluable but the interest on the loans is what has some civil society actors and economists worried. However there is also the reality of the lack of transmission lines for the immense hydro power project whose mission was to power Uganda’s industrial growth.

Kapwepwe says not all borrowing is bad since government may have to borrow for infrastructure development. Citing the Rukungiri–Kihihi–Ishasha–Kanungu Road, he says it is important because it “goes into the hinterland of tourism and connects the Kigezi region to Queen Elizabeth park”. He says the road has also facilitated transport of tea from surrounding areas.

“That’s a worthwhile investment,” Kapwepwe says. The 79km road has links with the border of Democratic Republic of Congo (DRC) and was constructed with a $57m loan from the African Development Bank.

Kapwepwe juxtaposes the above road with another in the eastern part of the country- the Mbale Lwakhakha Road which is also funded by ADB is mainly used for “drying of miserable cassava”.

“That is a white elephant,” he says.

Kapwepwe says another example of worthy borrowing for infrastructure is the Kapchorwa Suam Road financed by ADB at a cost of $105m. “That road enhances East African integration by connecting Uganda to Kitale (small town) in Kenya. It also boosts Kenya’s efforts to revamp wheat production in Sebei.” The Sebei sub region straddles both sides of the Ugandan and Kenyan borders.

At the time of groundbreaking for the project in August 2018, Kenya’s Deputy President William Ruto was in attendance with President Museveni to signify the importance of the project to the two countries. Both leaders spoke about the addition to the regional integration efforts. ( CLICK TO READ -continued on page 2)

The post Uganda’s debt burden appeared first on The Independent Uganda:.

from The Independent Uganda: https://ift.tt/338S8TT

0 Comments