Nairobi, Kenya | Xinhua | Kenya’s foreign exchange reserves fell a record 49 billion shillings (about 428 million U.S. dollars) this week as the shilling hit a new low amid strong dollar demand from importers.

The Central Bank of Kenya (CBK) said in its weekly update of the financial markets released Friday evening that the reserves fell from 8.715 billion dollars to 8.287 billion dollars, a new low.

During the week, the shilling declined to exchange at 114 against the dollar, down from 113, with the CBK reportedly using part of the reserves to support it.

A higher demand for dollars from importers to meet their end-month needs further put pressure on the forex reserves.

Despite the sharp decline, however, the CBK said the forex reserves remain adequate and continue to provide cover and a buffer against short-term shocks in the foreign exchange market. The new reserves cover 5.07 months of import cover, down from 5.33 months of cover.

“The usable foreign exchange reserves remain adequate. They meet the CBK’s statutory requirement to endeavor to maintain at least four months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover,” said the apex bank.

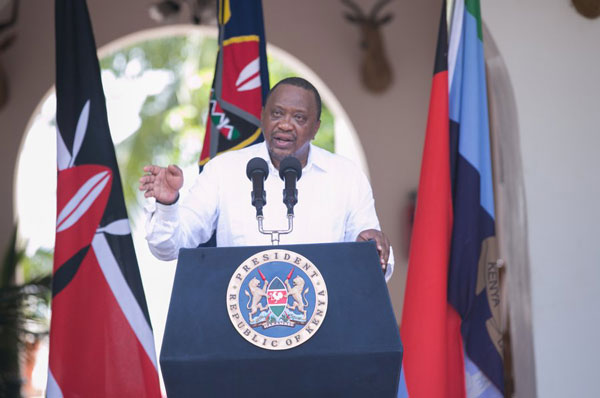

On Thursday, CBK governor Patrick Njoroge said inflows from east Africa’s major exports like tea declined in 2021, amid a rise in imports, thus, putting pressure on forex reserves.

The value of imported goods rose 25 percent in 2021 compared to a decline of 12.4 percent in 2020, reflecting an increase in oil and intermediate goods imports, said Njoroge.

The post Kenya’s forex reserves fall sharply as shilling plunges, dollars demand surges appeared first on The Independent Uganda:.

from The Independent Uganda: https://ift.tt/9aLZDVNFA

0 Comments