The lender is seeking opportunities for collaboration while becoming more agile to serve customers beyond traditional banking

Kampala, Uganda | ISAAC KHISA | ABSA Bank Uganda, a subsidiary of ABSA Group, a financial services conglomerate based in South Africa, has seen its profit more than double riding on the rebound of the economy, but weak credit demand took toll on its net customer assets.

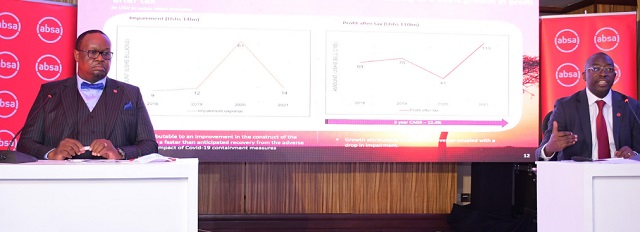

The country’s third largest bank by assets recorded a profit after tax of Shs 110billion in 2021, up from Shs 40billion in 2020. The bank’s bottom-line, like its peer, Stanbic Bank, was also boosted by a significant drop in impairment as more customers who had previously been hit with the coronavirus pandemic repaid their outstanding loans.

“Despite a tough operating environment, economic recovery was faster than anticipated evidenced by the remarkably resilient performance and expansion of the economy by an estimated 5.3%,” ABSA Bank Managing Director, Mumba Kalifungwa said.

“Private sector business growth was underpinned by a rebound in activity in agriculture, construction, and public administration.”

Mumba said the bank registered a significant drop in impairment of 77.8% as a result of increased improvement in the construct of their loan book signaling a faster than anticipated recovery from adverse economic impact of Covid-19 containment measures.

The bank also delivered a 15.4% growth in revenue to Shs365 billion, indicating a Shs 21 billion growth from 2020 owed to sustained customer deposit performance.

Still, the bank’s net customer assets grew marginally by 0.1% to Shs1.308 trillion as the pandemic weathered credit demand. Customers bank deposit grew 2.7% to Shs 2.42 trillion but maintained a cumulative annual growth rate of 10.6% for the past three consecutive years.

But the lender remains well capitalized with the total capital ratio of 24.3%, well above the 15% regulatory limit. The bank’s total assets increased from Shs3.5trillion to Shs4trillion during the same period under review, making it the third largest commercial bank in the country in terms of assets just behind Centenary and Stanbic banks.

Interest on deposits, placements and loans and advances were a bright spot at Stanbic which took advantage of high private sector’s appetite for loans and posted substantial growth in revenues.

At ABSA Bank, however, interest on deposits and placements and loans and advances fell from Shs 17.6billion and Shs 165.6billion in 2020 to Shs 6.7billion and Shs152.6billion last year, respectively.

New projections

Michael Segwaya, executive director and Chief Finance Officer at ABSA Bank Uganda said the lender expect a rebound in business activity across all sectors, and anticipate to lend more to the private sector in 2022.

Mumba said the lender is currently delivering against its strategic priorities centered on improving customer and digital experience, delivering, and protecting returns, developing its people, and ensuring a sustainable control environment.

“Our focus is on executing against these priorities at pace, and we are making progress on each of them,” he said. “Looking ahead, we are mindful of the evolution of banking and trends shaping the financial services sector. Transformation in the digital era has been further accelerated by the pandemic as customers seek convenience.”

Mumba said the lender will continue to seek opportunities for collaboration while becoming more agile to serve customers beyond the boundaries of traditional banking.

He said the bank is set to continue investing in new technology to develop robust and attractive digital systems with analytical capabilities, and augmented intelligence that will generate levels of customer engagement and operational efficiency.

****

The post ABSA Uganda profit more than double but credit demand takes a hit appeared first on The Independent Uganda:.

from The Independent Uganda: https://ift.tt/Ze9a47w

0 Comments